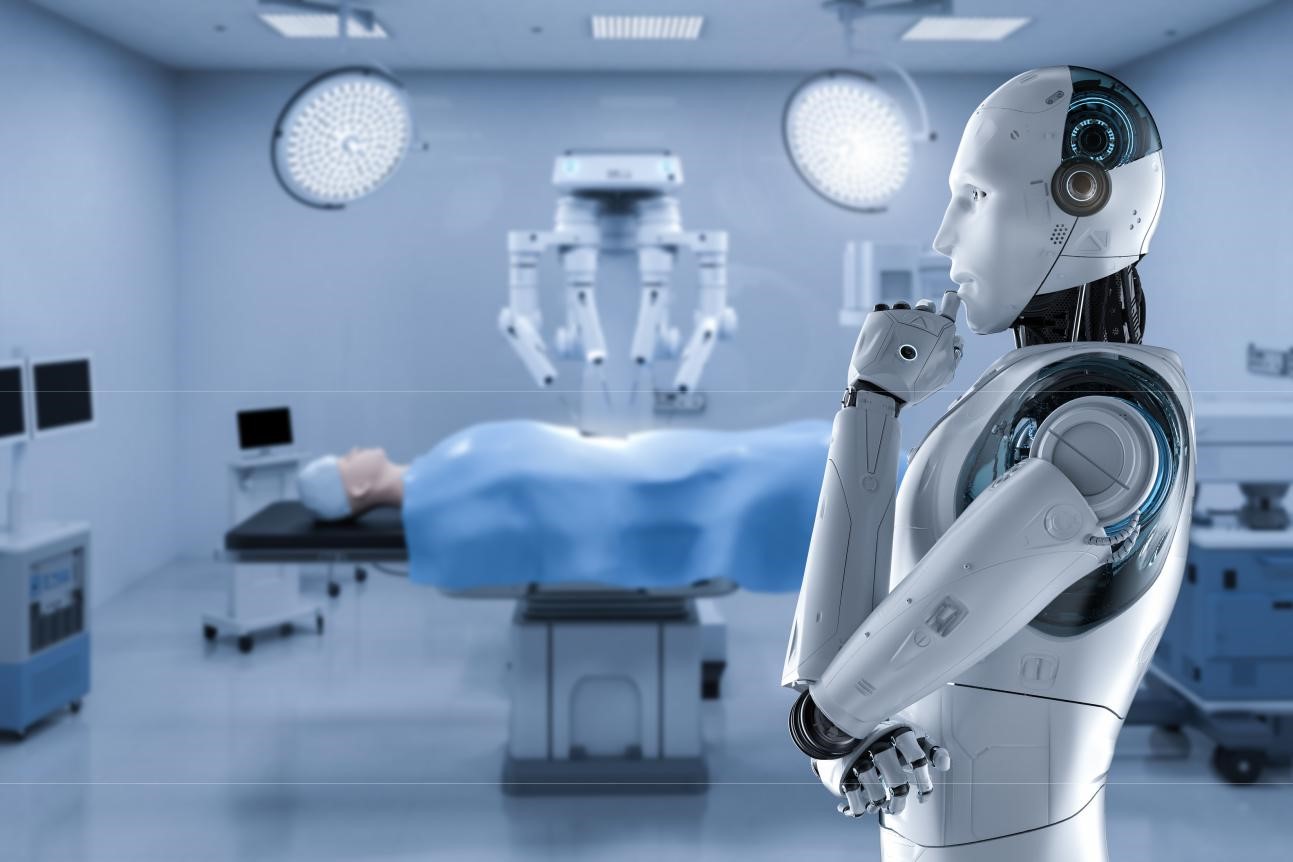

You’ve Pitched. You’ve Followed Up. Investors Still Aren’t Biting.

You spent weeks (or months) perfecting your pitch deck. You’ve sat across from investors, delivered your presentation, answered their questions—and then… silence. Another case of MedTech startup funding mistakes costing a great idea its chance.

No follow-up. No term sheet. No funding.

The brutal truth? It’s not them—it’s your pitch.

The vast majority of MedTech startups fail to secure funding, and it’s not because investors “don’t get it.” It’s because founders fall into the same MedTech startup funding mistakes that kill investor interest before a deal even gets started.

So what’s stopping your MedTech startup from getting funded? Here are the five MedTech startup funding mistakes—plus how to fix them fast.

1. Your Problem Statement Is Weak

Why This Kills Funding

Investors don’t fund products—they fund problems that demand a solution.

Yet, most MedTech founders make one of two critical mistakes:

- They either describe a solution in search of a problem (aka “we built this because we could”), or

- They fail to explain why the problem is urgent enough to demand funding right now.

How to Fix It

- Make the problem visceral. Start with a story, a statistic, or a jaw-dropping insight that makes investors feel the pain of the issue.

- Size the impact. How many patients, providers, or hospitals are affected? What’s the financial burden of not solving it?

- Show why now. What’s changed in the market, technology, or regulation that makes this problem ripe for innovation today?

Pro Tip: Instead of saying, “There’s a need for better catheter placement,” say:

“Every year, 250,000 U.S. patients suffer from catheter misplacement, leading to $1B+ in additional healthcare costs and thousands of preventable deaths. We’re solving that.”

2. Your Market Size Doesn’t Impress

Why This Kills Funding

Investors aren’t just buying into your idea—they’re buying into your market.

If your market size feels too small, too niche, or too theoretical, investors will immediately pass.

How to Fix It

- Use the TAM/SAM/SOM framework to show the total addressable market (TAM), serviceable available market (SAM), and serviceable obtainable market (SOM).

- Anchor your market size with real industry numbers. Example: If you’re in cardiovascular MedTech, cite data from FDA, JAMA, or MedTech Innovator.

- Show scalability. If your product starts in hospitals, can it expand to home care, telemedicine, or global markets?

Pro Tip: Instead of saying, “The market for our device is $500M,” say:

“Our TAM is $6.5B, but we’re focusing first on the $500M underserved hospital segment, where we can achieve 20% penetration in 3 years.”

3. Your Business Model Is Unclear

Why This Kills Funding

MedTech investors love science—but they invest in businesses, not research projects.

If your pitch deck lacks a clear revenue strategy, pricing model, or path to profitability, investors won’t see how they’ll get their money back.

How to Fix It

- Clearly explain your revenue model. (Direct sales? Licensing? SaaS? Device-as-a-service?)

- Highlight pricing & reimbursement. Have you validated CPT codes, insurance coverage, or hospital procurement models?

- Show your go-to-market strategy. Will you sell to hospitals, distributors, or directly to patients?

Pro Tip: Instead of saying, “We’ll figure out pricing later,” say:

“Hospitals will pay $10,000 per unit, with reimbursement under CPT code X1234. We’ve confirmed early purchase interest from three hospital networks.”

4. You’re Ignoring Regulatory Pathways

Why This Kills Funding

MedTech investors hate uncertainty.

If your regulatory plan is vague, missing, or unrealistic, investors will run for the hills.

How to Fix It

- Show a clear FDA/CE strategy. Is your product 510(k), De Novo, or PMA? What’s your submission timeline?

- Demonstrate risk mitigation. Have you spoken to regulatory consultants? Do you have a plan for clinical trials, IRB approval, or compliance?

- Highlight early wins. Have you filed patents, secured pre-sub meetings, or started clinical pilots?

Pro Tip: Instead of saying, “We’ll get FDA approval,” say:

“We’re pursuing a 510(k) submission in Q3 2024, with a pre-sub meeting already scheduled. Our regulatory pathway de-risks the process for investors.”

5. Your Pitch Lacks Energy

Why This Kills Funding

If you don’t sound excited about your MedTech startup, why should investors be?

Too many founders overload their decks with data or product features and benefits but fail to sell the vision with energy, conviction, and a sense of urgency.

How to Fix It

- Practice your delivery. Pitch with confidence, clarity, and passion.

- Make eye contact. Investors back leaders—not just technology.

- Don’t just talk about what you’ve built—talk about the future. Investors need to see the big picture.

Pro Tip: Instead of reading from slides, engage investors like a storyteller. The best pitches feel more like TED Talks, not board meetings.

Fix It Now: 15 Strategic Slides to Secure Your Next Round of Funding

Think your pitch might be costing you funding opportunities? It’s time to audit, refine, and fix it—before your next investor meeting.

📥 Download Free “15 Strategic Slides to Secure Your Next Round of Funding”—the same framework Tribe Consulting Agency uses to help MedTech innovators win investor confidence and secure capital.

👉 Get it here

Final Takeaway: The Right Pitch Changes Everything

💡 Funding isn’t just about the best technology—it’s about the best pitch.

💡 The right narrative, market strategy, and investor confidence can turn a ‘no’ into a ‘yes.’

If you want expert eyes on your pitch deck, fundraising strategy, and investor messaging, Tribe Consulting Agency can help. Connect with experts in medtech startups and innovation.

👉 Let’s build your winning pitch—so you can land the funding your MedTech startup deserves.

Read the Comments +